WHAT IS THE TARIFF CODE? THE ULTIMATE GUIDE

Importing and exporting goods into Malaysia and working with the country’s customs almost always come with cumbersome processes and paperwork. That includes Malaysia, which also requires businesses to declare the trade goods using an important identifier: HS code.

If you’re a business owner trying to ship your goods overseas, understanding HS codes is a must to ensure a smooth logistical operation. Here, we’ll give you a quick overview of how these tariff codes work as well as how to read and determine the HS codes for your goods.

Tariff Codes Explained

What is Tariff Code?

The first question that you might have right now might be, what is a Tariff code and how is it different from the HS Code that we just mentioned?

Well, the answer is simple. They are both the same.

Harmonized System (HS) codes are often used interchangeably with Tariff Code.

Tariff Code is an internationally recognized numerical system created by the World Customs Organization (WCO) with the purpose to facilitate international trade by easing the task of identifying and categorizing traded goods.

These numbers exist for every product involved in global commerce. While it may not be necessary for all international shipments, a tariff code is required on official shipping documents for tax assessment purposes.

This serves as the basis for the import and export classification system, ensuring uniformity of product classification worldwide.

Besides applying tariffs and duty rates, tariff codes can also be used to:

- Demonstrate custom competency

- Declare permits and rules of origin of goods

- Collect trade statistics

The tariff system assigns specific codes for varying classifications and commodities, with most of them ranging from 6 to 10 digits long.

In short, the more digits a tariff code has, the more specific the product classification.

Those with a string with less than 6 digits are referred to as partial tariff codes, representing a broad product category or chapter of products as opposed to a specific classification.

Import and Export Tariffs in Malaysia

One thing to note is that Malaysia follows two HS code classifications: Harmonized System (HS) and ASEAN Harmonised Tariff Nomenclature (AHTN).

Besides the standard HS, Malaysia also follows the AHTN for imported and exported goods originating specifically from any other members of the Association of Southeast Asian Nations (ASEAN).

Malaysia’s tariffs are typically imposed on an ad valorem basis, which means that the taxes levied on imported and exported goods will be in accordance with the property’s value as determined by an assessment or appraisal.

However, as a rule of thumb, when it comes to imported goods, you can expect the tariff rate to be anywhere from 0% to 50%, with the average rate being 6.1% for industrial goods.

That said, Malaysian customs apply higher tariff rates for specific duties that either have a considerably high domestic production rate or are considered ‘sinful’ goods. These goods can be products such as pork, wine, and alcohol.

On the other hand, raw materials for use in manufacturing exported goods may be subjected to either a reduced tariff or a tariff exemption altogether.

As for exported goods, Malaysian customs apply a tariff between 0% to 10%, following the same ad valorem rates.

In addition, according to Malaysia’s Customs Act (1976), companies may get a 90% refund on tariffs paid for exported goods originally sourced from their imported counterparts.

The Breakdown of HS code

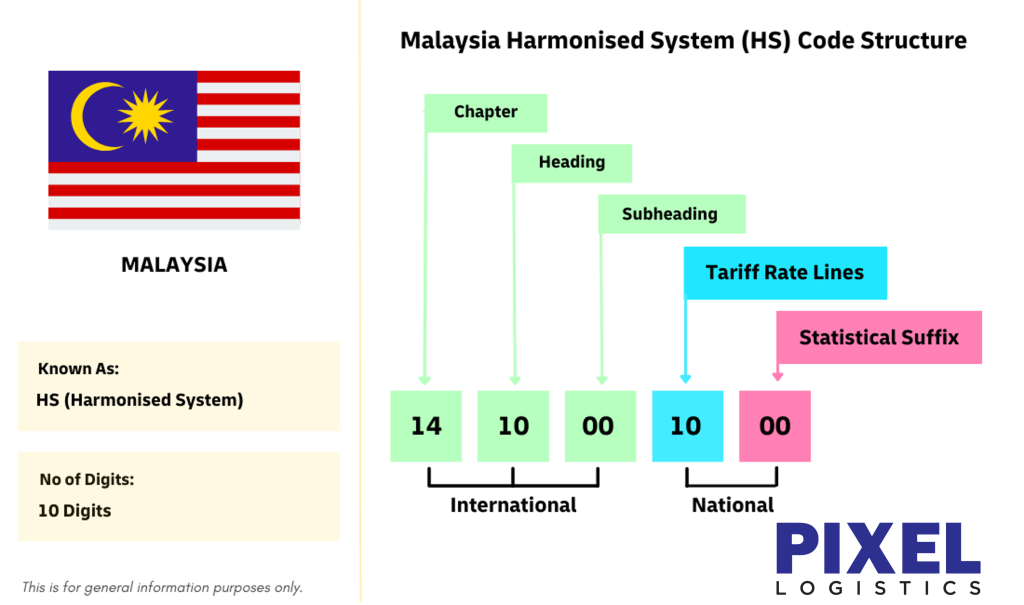

Every HS code has a layer-by-layer structure, broken down into 5 different sections to represent the respective categories: chapters, headings, subheadings, subheadings (tariff rate lines), and statistical suffixes.

The first 6 digits are the HS number under the international HS, while the last 4 digits (if any) are specific to the country.

Chapter: The first 2 digits identify the chapter in the HS.

Heading: The next 2 digits represent the heading within the said chapter in the HS.

Subheading: The next 2 digits identify the subheading within the heading.

Subheading (tariff rate lines): These 2 digits establish the duty rates, and are specific to Malaysia.

Statistical suffixes: The last 2 digits are statistical suffixes used to collect trade data. Similarly, these digits are specific to Malaysia.

Chapter: The first 2 digits identify the chapter in the HS.

Heading: The next 2 digits represent the heading within the said chapter in the HS.

Subheading: The next 2 digits identify the subheading within the heading.

Subheading (tariff rate lines): These 2 digits establish the duty rates, and are specific to Malaysia.

Statistical suffixes: The last 2 digits are statistical suffixes used to collect trade data. Similarly, these digits are specific to Malaysia.